CSGO Loot Arena

Your ultimate destination for CSGO loot, tips, and community news.

Withdrawal Whirlwind: Navigating Methods and Fees Without the Headache

Master the maze of withdrawal methods and fees with ease! Dive into our guide for stress-free navigating and save big today!

Understanding Withdrawal Methods: A Comprehensive Guide

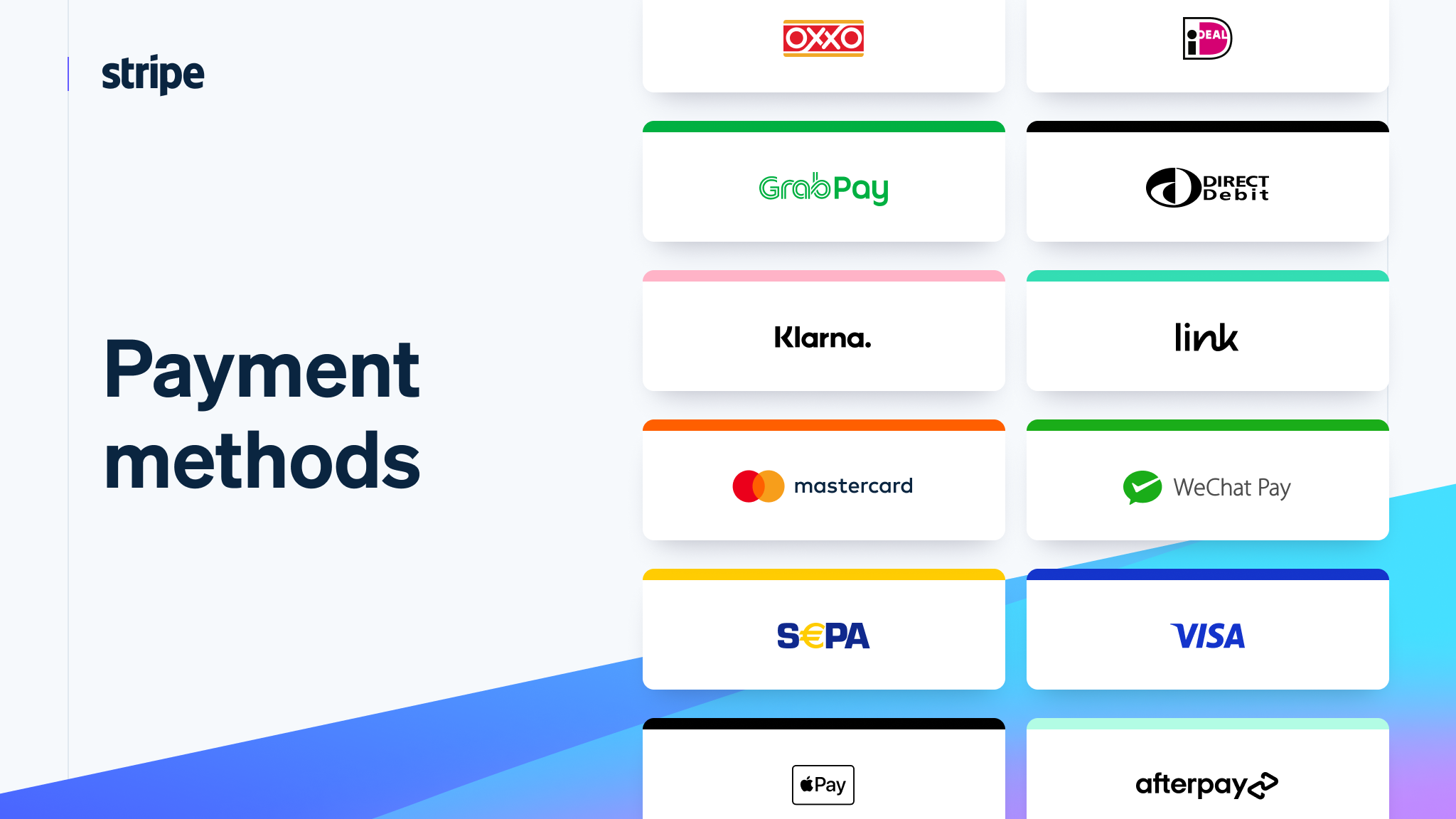

Understanding withdrawal methods is crucial for individuals navigating the world of online transactions, whether it involves trading, gambling, or e-commerce. This comprehensive guide will delve into various withdrawal methods available today, discussing their pros and cons to help you make informed decisions. From bank transfers and e-wallets to cryptocurrency options, knowing how each method works and what to expect in terms of speed, fees, and security is essential to ensure a smooth experience.

One common category of withdrawal methods is traditional banking options, which often include checks and direct bank transfers. These methods are generally considered secure, but they may come with longer processing times and potential fees. In contrast, e-wallets offer faster transactions, allowing users to access their funds quickly; however, they may incur varying fees depending on the service provider. Understanding the nuances of each method, such as transaction limits and verification processes, will empower you to choose the option that aligns with your needs.

Looking for great offers? Check out the latest duel promo code to unlock exclusive benefits and enjoy an enhanced experience.

The Hidden Costs of Withdrawals: Breaking Down Fees

When considering the hidden costs of withdrawals, it’s crucial to look beyond the standard fees that banks or financial institutions may advertise. Often, users encounter additional charges that can significantly impact their finances. For instance, many banks impose withdrawal fees when accessing funds from ATMs that do not belong to their network. These fees can range from $2 to $5 per transaction, which might seem minimal at first glance, but can add up quickly for frequent users. Additionally, some banks charge foreign transaction fees for withdrawals made abroad, which can be as high as 3% of the total transaction amount.

Moreover, the hidden costs of withdrawals extend beyond just fees; they can also include time and opportunity costs. For example, if you frequently withdraw small amounts of cash, you may end up losing out on higher interest rates associated with maintaining a larger balance. Furthermore, if you are regularly withdrawing from investment accounts, you might be subject to tax implications depending on your account type and jurisdiction. To avoid these pitfalls, it’s essential to understand the full picture of withdrawal fees and their effects on your financial health. Consider creating a budgeting strategy that minimizes withdrawals or enhances your awareness of associated costs.

Top Tips for Seamless Withdrawals: Avoiding Common Pitfalls

When it comes to withdrawals, having a clear strategy can make all the difference. Here are some top tips for seamless withdrawals:

- Understand the Terms and Conditions: Before initiating a withdrawal, carefully read the terms associated with your account. Different platforms have varying rules regarding fees and processing times so ensure that you are well-informed.

- Verify Your Identity: Many platforms require you to complete identity verification to avoid fraudulent activities. Completing these checks in advance can speed up your withdrawal.

Additionally, keeping track of your withdrawal requests is crucial. Ensure you maintain records of all transactions and stay updated on withdrawal timelines. It’s also wise to consider the following:

- Choose the Right Method: Select a withdrawal method that aligns with your needs. Some options may offer faster processing times than others.

- Stay Within Limits: Be aware of any withdrawal limits imposed by your chosen service. Exceeding these limits can lead to unnecessary delays and complications.